Choosing the right path to entrepreneurship can significantly impact your success and satisfaction as a business owner. Each route—starting a business from scratch, buying into a franchise, or purchasing an existing business—offers unique opportunities and challenges. Understanding these differences can help you make an informed decision that aligns with your goals, resources, and risk tolerance.

Starting a Business from Scratch

Pros:

- Creative Freedom: Starting from scratch allows you to build your business exactly the way you envision. Every decision, from branding to business model, is entirely yours.

- Control: You have full control over the direction, culture, and operations of the business.

- Satisfaction: The sense of accomplishment from seeing your idea grow into a successful business can be immensely rewarding.

Cons:

- High Risk: New businesses face high failure rates, especially in the first few years. The financial and emotional risks are significant.

- Time-Consuming: Building a business from the ground up requires significant time and effort. It can take years to establish a stable revenue stream.

- Resource Intensive: From initial capital investment to ongoing funding needs, startups often require substantial financial resources.

- Limited Financing Options: Securing financing for a startup can be challenging, often requiring investments from friends and family to get started.

Buying a Franchise

Pros:

- Proven Business Model: Franchises come with an established brand, a proven business model, and a track record of success.

- Support and Training: Franchisors typically offer extensive training and ongoing support, reducing the learning curve for new owners.

- Marketing Assistance: Franchises often benefit from national or regional advertising campaigns funded by the franchisor.

Cons:

- Less Autonomy: Franchisees must adhere to the franchisor’s rules and guidelines, limiting their ability to make independent decisions.

- Initial and Ongoing Fees: Franchise owners must pay an initial franchise fee and ongoing royalties, which can eat into profits.

- Brand Reputation Risk: Your business’s success is tied to the overall reputation of the franchise. Issues at other locations can impact your business.

- Financing Available: There are financing options available for established franchise brands, including loans from banks and financial institutions.

Buying an Existing Business

Pros:

- Established Operations: Buying an existing business means acquiring an established customer base, operational systems, and cash flow from day one.

- Known Financials: You can review the business’s financial history to understand its performance and profitability.

- Reduced Risk: Existing businesses typically come with lower risks compared to startups, as they have already proven their viability in the market.

- Financing Available: There are often more financing options available for purchasing an existing business, including loans from banks and financial institutions.

Cons:

- High Upfront Cost: The initial investment to purchase an established business can be substantial.

- Inherited Issues: You may inherit existing problems, such as poor employee morale, outdated processes, or pending legal issues.

- Limited Creative Input: There is less opportunity to shape the business according to your vision, especially if it has a well-established brand and operations.

Each entrepreneurial path offers unique benefits and challenges. The best choice depends on your personal preferences, risk tolerance, financial resources, and long-term goals.

- If you value creative freedom and are willing to take on high risk, starting a business might be the right path.

- If you prefer a proven model with support but are okay with some restrictions, a franchise could be ideal.

- If you want an established operation with immediate cash flow and can handle a higher initial investment, buying an existing business may be the best option.

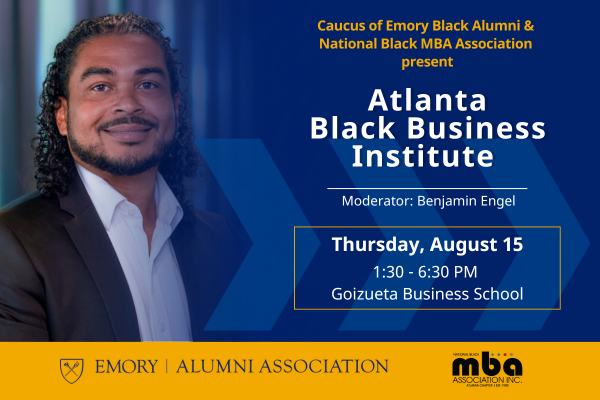

Live Panel Discussion

To dive deeper into this topic, join us at our upcoming panel discussion moderated by Benjamin Engel of Edge Mergers & Acquisitions. Gain insights from industry experts, hear real-life experiences, and get your questions answered. Don’t miss this opportunity to explore which entrepreneurial path is best for you.

For more information and to register, click here.

Benjamin Engel

:

Jul 31, 2024 2:52:11 PM

Benjamin Engel

:

Jul 31, 2024 2:52:11 PM