Stacking the Odds in Your Favor When Buying a Business

I’m traveling to Las Vegas this week, a city that’s built on risk, rewards, and the thrill of chance. Walking past the bright lights and busy...

2 min read

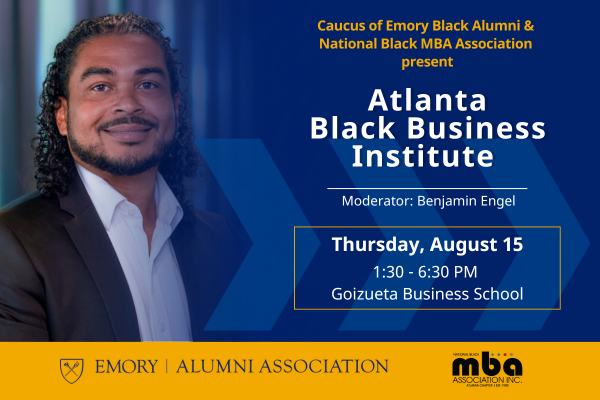

Benjamin Engel

:

Sep 4, 2023 9:29:21 PM

Benjamin Engel

:

Sep 4, 2023 9:29:21 PM

Writing an offer to purchase a small business requires careful consideration and attention to detail.

Research and Due Diligence: Before writing the offer, conduct thorough research on the business. Understand its financials, market position, competition, assets, liabilities, and any legal or operational issues. This will help you determine the business's true value and make an informed offer.

Engage Professionals: Consider hiring professionals such as business brokers, accountants, and lawyers to assist you in evaluating the business and drafting the offer. Their expertise can be invaluable in ensuring that your offer is fair and legally sound.

Engage Professionals: Consider hiring professionals such as business brokers, accountants, and lawyers to assist you in evaluating the business and drafting the offer. Their expertise can be invaluable in ensuring that your offer is fair and legally sound.

Determine the Purchase Price: Calculate the purchase price based on the business's current and potential future earnings, assets, and industry standards. Consider using valuation methods such as earnings multiples, asset valuation, and discounted cash flows.

Offer Structure: Decide on the structure of the offer. Will it be an all-cash offer, seller financing, or a combination of both? Clearly outline the terms of the payment, including the down payment and any installment payments.

Contingencies: Include any necessary contingencies in the offer, such as due diligence, financing, lease assignment, and any regulatory approvals. Contingencies protect you in case certain conditions aren't met.

Earnest Money Deposit: Consider including an earnest money deposit along with your offer. This deposit shows your commitment to the transaction and is typically held in escrow until the deal is finalized.

Timeline: Specify a timeline for the transaction, including key milestones such as due diligence completion, financing approval, and the closing date. A clear timeline demonstrates your seriousness as a buyer.

Seller Transition: If you plan to retain the current owner as a consultant or employee during the transition period, outline these terms in the offer.

Letter of Intent (LOI): For larger transactions, before diving into a comprehensive purchase agreement, consider starting with a non-binding Letter of Intent (LOI). This document outlines the basic terms of the offer and serves as a starting point for negotiations.

Negotiation Leverage: Keep some negotiation leverage in reserve. Don't start with your best offer, but leave room for some negotiation while still maintaining a fair deal.

Professional Language: Write your offer professionally and clearly. Avoid using jargon or overly complex language. Make sure the offer is easy for both parties to understand.

Personalization: While professionalism is key, also include a personal touch in your offer. Explain why you're interested in the business and how you plan to take it forward. This can create a positive impression on the seller.

Personalization: While professionalism is key, also include a personal touch in your offer. Explain why you're interested in the business and how you plan to take it forward. This can create a positive impression on the seller.

Review and Proofread: Thoroughly review and proofread the offer before submitting it. Typos or unclear terms can give a negative impression and affect your negotiation position.

Flexibility: While you should be clear in your terms, be open to some flexibility during negotiations. This can help create goodwill and facilitate a smoother process.

Remember, purchasing a business is a significant decision. Take your time to ensure your offer accurately reflects your intentions and goals as a buyer. It's also important to consult with legal and financial professionals throughout the process to protect your interests.

Join our insider community for early deal alerts, exclusive resources, and expert insights on buying and selling businesses.

Learn more about selling your business.

For all of the latest educational content, be sure to subscribe below:

I’m traveling to Las Vegas this week, a city that’s built on risk, rewards, and the thrill of chance. Walking past the bright lights and busy...

When you’re buying a business, one of the first questions you should ask yourself is: “What kind of return am I going to get on this investment?”...

Choosing the right path to entrepreneurship can significantly impact your success and satisfaction as a business owner. Each route—starting a...